SMSF vs Industry Super: Why SMSF balances are 300% larger at retirement

When it comes to building wealth for retirement, not all super funds are created equal.

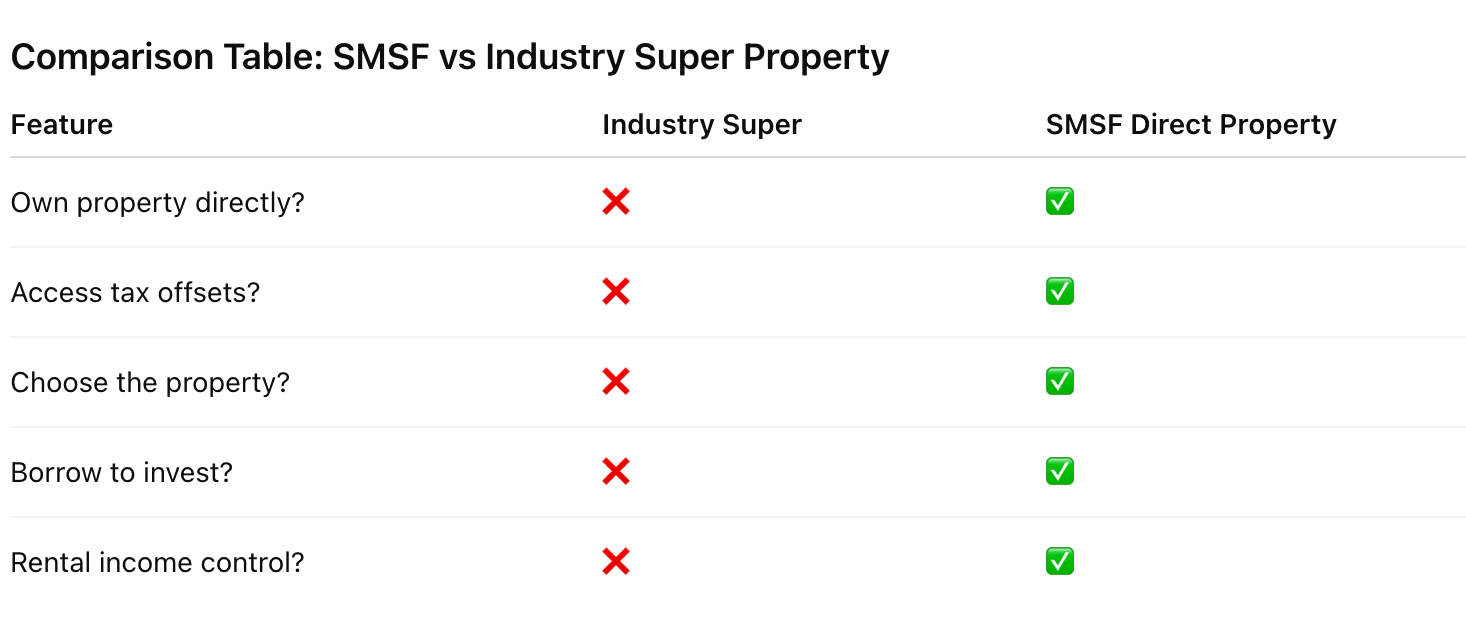

The biggest difference? Property ownership. SMSFs allow you to own property directly. Industry super funds don’t. And that difference changes everything.

How Industry Super Handles Property

Industry funds give members exposure to property by investing in trusts, REITs, or pooled property funds. You own “a slice” of property, but never the actual asset.

This means:

You don't own property or a title.

No control over tenants or rent.

No direct tax benefits.

How SMSFs Handle Property

With an SMSF, the fund itself owns the property. You and your trustees control:

Which property is purchased

How it’s managed

When it’s sold

You receive the rental income and capital growth directly into your super.

Why Direct Ownership Matters

Control: You choose the property that fits your goals.

Transparency: You know exactly what your fund owns.

Tax Benefits: You access deductions and CGT concessions directly.

Growth Potential: Borrowing allows you to buy higher-value assets.

Conclusion

If you want average results, industry super works. If you want control, transparency, and the chance to accelerate wealth, SMSFs with direct property ownership are the way to go.

👉 Ready to compare your options in detail?

We're the ARO

At the Australian Retirement Office (ARO), our mission is simple: to help Australians retire better.

We believe retirement shouldn’t be left to chance or hidden inside industry super funds with limited control. For decades, Australians have built wealth through property, business, and smart tax strategies. That’s exactly what we help our clients bring into their super.

With a focus on clarity, control, and confidence, ARO provides education and strategies that put the power back in your hands, so you can retire on your terms.

Download the 200K SMSF Case Study

At the Australian Retirement Office (ARO), our mission is simple: to help Australians retire better.

We believe retirement shouldn’t be left to chance or hidden inside industry super funds with limited control. For decades, Australians have built wealth through property, business, and smart tax strategies. That’s exactly what we help our clients bring into their super.

With a focus on clarity, control, and confidence, ARO provides education and strategies that put the power back in your hands, so you can retire on your terms.

www.ausretirementoffice.com.au